![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

|

Financial accounting |

The primary focus of financial accounting is on the information needs of investors and creditors.the |

|

|

The financial statements most frequently provided are… |

Balance sheet Income statement Statement of cash flows Statement of shareholders equityt |

|

|

3 primary forms of business organizations |

Sole proprietorship Partnership Corporation |

|

|

Net operating cash flow |

Net operating cash flow is the difference between cash receipts and cash disbursements from providing goods and services. |

|

|

Net income |

Net income is the difference between revenues and expenses. Revenue-expenses = net income |

|

|

GAAP |

Is a dynamic set set of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes |

|

|

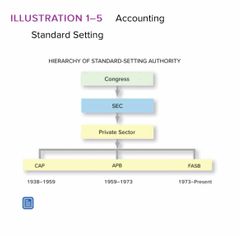

Financial Accounting Standards Board (FASB) |

The FASB was established to set U.S. accounting standards. |

|

|

Accounting Standard Setting |

Back (Definition) |

|

|

Relevance |

Predictive value Confirmatory value Materiality |

|

|

Relevance |

Predictive value Confirmatory value Materiality |

|

|

Faithful representation |

Completeness Neutrality Free from error |

|

|

Hierarchy of Qualitative Characteristics of financial information |

Back (Definition) |

|

|

Enhancing qualitative characteristics |

Comparability Verifiability Timeliness Understandability |

|

|

The qualitative characteristic that means there is an agreement between a measure, and a real world phenomenon is |

Representational faithfulness |

|

|

Relevance requires that information possess predictive, and / or |

Confirmatory value |

|

|

The two primary decision specific qualities that make accounting information useful are |

Relevance and faithful representation |

|

|

The primary objective of financial reporting is to provide information |

That is useful in decision making |

|

|

Financial statements generally include all of the following, except |

Federal income tax return |

|

|

Going concern |

The underlying assumption that presumes a company will continue indefinitely |

|

|

Periodicity |

The underlying assumption that assumes that the life of a company can be divided into artificial time periods |

|

|

Revenue typically should not be recognized until |

The seller has transferred goods or services to a customer |

|

|

Journal |

A chronological record of all economic events affecting a firm |

|

|

The reason we post journal entries is to |

Reflect the information in journal entries in ledger accounts |

|

|

Current ratio |

Total current assets / total current liabilities |

|

|

Working capital |

Total current assets - total current liabilities |

|

|

Acid test ratio |

(Total current assets - Inventory - Prepaid expenses) / Total current liabilities |

|

|

Debt to equity ratio |

Total Liabilities / Total Shareholder’s equity |

|

|

Quick acid total |

Total current assets - inventory - prepaid expenses |

|

|

Restricting cause typically can be defined as |

Cost associated with management plan to materially, change the scope of business operations, or the manner in which they are conducted |

|

|

Operating cash flows would NOT include |

Dividends paid |

|

|

Cash flows from investing activities include |

Payment for the purchase of equipment Proceeds from the sale of Marketable securities Cash outflows from acquiring land |

|

|

In a period when costs are rising, and inventory quantities are stable the inventory method that would result in the highest any inventory is |

FIFO |

|

|

The capitalized cost of land excludes |

Property taxes for the first year owned |