![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

|

Attempts to measure likelihood of variability of future returns from proposed investment

|

Risk Analysis

|

|

|

7 Approaches to Risk Assesment

|

1. Informal Method

2. Risk adjusted discount rates 3. Certainty equivalent adjustments 4. Simulation analysis 5. Sensitivity analysis 6. Monte Carol technique 7. Capital Asset Pricing Model |

|

|

NPVs are calucated and apparently less risky project is chosen

|

Informal method

|

|

|

Technique adjust rate of return upward as investment becomes riskier

|

Risk-adjusted discount rates

|

|

|

Forces decision maker to specify at what point firm is indifferent to choice between certain sum of money and ecpected value of risky sum

|

Certain equivalent adjustments

|

|

|

Computer is used to generate many examples of results based upon various assumptions

|

Simulation Analysis

|

|

|

Forecast of many calculated NPVs under various assumptions are compared to see how sensitive NPV is changing conditions. (What-if technique)

|

Sensitivity Analysis

|

|

|

Technique is often used in simulation to generate the individual values for random variable

|

Monte Carol Technique

|

|

|

Method is derived from use of portfolio theory. More sensitive an asset's rate of return is to change in market's rate of return, the riskier the asset.

|

Capital Asset Pricing Model (CAPM)

|

|

|

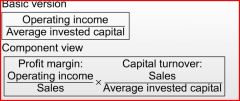

Return on Investment (ROI)

|

|

|

|

Residual Income

|

Net Income - (Average Total Assets * Target rate of return)

|

|

|

Return on assets (ROA)

|

Net Income/Average Total assets

|

|

|

Return on common equity (ROCE)

|

(Net Income - Preferred dividends)/ Average common equity

|

|

|

Economic Value Added (EVA)

|

After tax OI= After tax WACC*(Total assets - current liabilities)

|

|

|

Firm's ability to pay its noncurrent obligations as they come due and thus remain in business in long run

|

Solvency

|

|

|

Capital structure ratios

|

1. Total debt to total capital

2. Debt to equity 3. Long term debt to equity 4. Debt to total assets |

|

|

The excess of the amount of the ROI over a targeted amount equal to an imputed interest charge on invested capital

|

Residual income

|

|

|

Profitability index

|

PV of future net cash flows or NPV of project/Initial investment

|

|

|

Types of real options

|

1. Abandonment of project (exceeds NPV of future cash flows)

2. Option of follow up investment (NPV of project b/c of inefficient scale) 3. Wait,learn 4. Flexibility 5. Capacity 6. Geographical market 7. New product option |

|

|

A firm earning a profit can increase its return on investment by

|

A firm earning a profit can increase its return on investment by

|