![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

37 Cards in this Set

- Front

- Back

|

Measures of national income level |

GDP and GNP |

|

|

Measures of economic level of development |

GDP per capita |

|

|

Measures of income equality |

Gini Index, Intergenerational income mobility (0-1, lower the more equal) |

|

|

Balance of Payments |

Financial (financial assets) = Current (goods) + Capital (non market) |

|

|

Top trading partners in U.S. |

Canada, China, Mexico, Japan, Germany |

|

|

private saving = ? |

Sp = I + CA + (G – T)

Private saving = investment + foreign wealth + governmentdebt (deficit) |

|

|

private saving is important because? |

cushions economic downturn increases countries investment (S=I) |

|

|

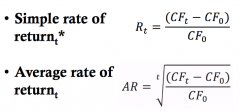

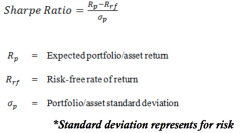

Evaluating Assets |

Expected Rate of Return (simple RoR, Average RoR) Risk (Standard Dev (difference between variables), Volatility(time series)) Sharp Ratio (expected return of portfolio) |

|

|

Forward Rate? helps you understand? useful? |

exchange rate quoted for future, what the bank thinks will happen in future, can take now (lock in future return) |

|

|

Forward Exchange Swap |

Aspot sale of a currency combined with a forward repurchase of the currency

|

|

|

Futures Contract |

Apromise that a specific amount of foreign currency will delivered on a specificdate with a specific price (1 transaction)

|

|

|

Options (put and call) |

The right to buy or sell a specified amount offoreign currency at a specified price at any time up to the expiration date

|

|

|

4 major actors in foreign exchange market |

Commercial banks, corporations non-bank financial organizations, central banks |

|

|

Foreign exchange equilibrium |

same expected rate of return for all currencies |

|

|

Interest parity |

same rate of return for 2 currencies (essentially all currencies) |

|

|

Rate of Return? |

|

|

|

World Major Currencies |

British Pound (£), Japanese Yen (¥), ChineseRenminbi(Yuan) (¥), Euro (€), and US Dollar ($)

|

|

|

Banks hold major currencies in reserve because? |

trust level and demand is high, willing to exchange any currency for the majorcurrencies. The major world currencies exhibit greater economic stability andare essentially reliable.

|

|

|

Vehicle currency and majors? |

The currency used to buy anotherforeign currency

Euro(39%), USD (37%) , Yen (19%) |

|

|

Arbitrage =? helps? |

purchase and sale to profit from difference inprice. It helps bring the market exchange rate to equilibrium (buying lowselling high)

|

|

|

Why almost no difference between NY and London exchange? |

high frequency of trading due to computers inthe stock market. buying low and selling high – the act of arbitrage. As thedemand increases, the market will simultaneously increase as well whilearbitragers are selling.

|

|

|

Golden Rule? |

higher the better |

|

|

Why portfolio diversification? |

Hedge risk, uncertainty of future return |

|

|

Correlation of asset returns |

For example 2 differentkiwi producers, negative correlation of -1 so they have opposite outcomes. Badseason risk cancels out and they should swap 50% shares/ownership with eachother, together they always produce.

|

|

|

Types of international assets |

Debt (Fixed income) bank deposits (cash), bonds Equity (volatile income) stock, corporate bond, real estate, business acquisition |

|

|

3 differences between commercial and investment banks |

Commercial banks take deposits, IB does not Commercial banks underwrite bonds, IBunderwrite bonds and IPOs (initial public offering = buying shares pre-stockmarket) *risky

Commercial banks are not allowed to bet onequity market, IB can do that *Glass-Steagall Act of1993 and its repeal in 1999 |

|

|

Bank Run Why? Fragile because? |

large and sudden loss of deposits cannot meet liabilities run out of capital maturity missmatch |

|

|

Prevent Bank Run (6 safeguards on financial stability) |

Deposit insurance (insures depositors) Reserve requirement (holding liquid assets) Capital requirements and asset restrictions (min cap requirement and regulates risky assets like stock) Bank examination (audit and force sell assets) Lender of last resort facilities (borrow from central bank) Government-organized restructuring and bailouts (central bank buys failed bank) |

|

|

3 types of offshore banking and regulations |

1. Agency office – arranges loans and transferfunds but does not accept deposits

2. Subsidiary bank –controlled by foreign bank headquarter, but subject to same regulation as localbanks 3. Foreign branch – an officeof home bank in another country, subject to both local and home bankingregulations |

|

|

Eurodollars |

dollars deposited outside U.S. also: Eurocurrencies – offshorecurrency deposits Eurobanks – banks that acceptdeposits denominated in Eurocurrencies |

|

|

Shadow Banking |

Alternative to borrowing, non-bankfinancial institutions providing payment and credit services |

|

|

Major shadow bankers |

hedge fund, insurance companies, mutual andpension funds.

|

|

|

Moral hazard =? |

less care to prevent an accident if you areinsured

|

|

|

moral hazard prevention? |

Prevention focus (end of year deduction) loss vs no loss

Promotion (base salary end ofyear bonus) gain vs no gain |

|

|

Regulatory Arbitrage |

shifting risky business fromhome regulators to places where few questions are asked

Ex: IPO's, set up subsidiary bank |

|

|

Credit Ratings |

Investment grade > BBB-> high risk, non investment grade

|

|

|

Rent seeking =? |

increase one’s share of existingwealth without creating new wealth (ex: licensing, your not generatinganything, or land lord)

|