![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

29 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

The purpose of the IS is to provide info about

the uses of funds in the income process - _________ , the uses of funds that will never be used to earn income - __________ , the sources of funds created by those expenses - __________, and the sources of funds not associated with the earnings process - __________ |

EXPENSES

LOSSES REVENUES GAINS |

|

|

|

The IS is useful in determining __________, _________ for investment purposes and credit__________.

|

PROFITABILITY

VALUE WORTHINESS |

|

|

|

Cost is the amount actually paid for something.

If COST is expensed immediately - it is ________ cost; if NOT expensed immediately - it is ________ |

PERIOD

CAPITALIZED = ASSET |

|

|

|

Unexpired cost is _________ because it can generate revenue in the future.

|

ASSET

|

|

|

|

_________ and _________ are normal reacuring operations , both separately reported at their ________ amounts

|

REVENUES AND EXPENSES

GROSS |

|

|

|

__________ and _________ are nonoperating income and reported at their _________ amounts.

|

GAINS AND LOSSES

NET |

|

|

|

COGS =

|

BI .

+ GOGM/purchases - EI . _________________ COGS . |

|

|

|

In the SINGLE STEP IS presentation of income from continuing operations, total _______ are subtracted form total ________ .

|

EXPENSES

REVENUES |

|

|

|

iDea - Discontinued operations

- are reported separately from continuing operations in the IS in the period in which they occur - anticipated losses NOT allowed. The loss form Discontinued operations can consist of an (3) |

1 impairment loss

2 G/L form actual operations 3 G/L on disposal |

|

|

|

A component of a business is classified as "Held for sale" in the period in which ALL criteria are met:(6)

|

1. Plan to sell

2 available for immediate sale 3 active to locate a buyer 4 expected to sell within ONE year 5 is being actively marketed 6 significant changes are unlikely |

|

|

|

Both of the following conditions must be met in order to report

income from DISCONTINUED operations : |

1 ELIMINATED FROM ONGOING OPERATIONS

2 NO SIGNIFICANT CONTINUING INVOLVEMENT |

|

|

|

Report the results of DISCONTINUED operations in period component is

DISPOSED OF or IS CLSSIFIED AS HELD FOR SALE. Types of items included : (3) |

1 revenues/expenses of the component - for that period

2 G/L on Disposal - in the period of sale 3 Impairment Loss and Subsequent increase in FV SP/NRV < BV, report immediately in the period HELD FOR SALE |

STAR

|

|

|

The results of DISCONTINUED operations, net of ________, are reported as a separate component of IS before the _________.

G/L disclosed in ______ or in ________ |

TAX

EXTRAORDINARY FACE OR NOTES |

STAR

|

|

|

idEa - EXTRAORDINARY ITEMS -

must be _____ AND _________ |

UNUSUAL AND INFREQUENT

|

|

|

|

MATERIAL Unusual OR Infriquent items shoul be reported as a separate line item as part or income from ___________________ at ____ amount.

|

CONTINUING OPERATIONS

GROSS |

|

|

|

INCOME STATEMENT

Normal reoccurring operations list the items for multiple step |

Net sales

Cost of sales ----------------------------------- Gross margin Selling expense G&A expenses Depreciation Expence ----------------------------------------- Income (loss) from operations |

|

|

|

INCOME STATEMENT

Non-operating list the items for multiple step |

OTHER revenues and gains:

Interest Income Gain on transactions in foreign currencies OTHER expenses and losses: Interest Expense Loss on sale of fixed assets INCOME before unusual items and income tax UNUSUAL or infrequent items Gain on litigation settlement Gain on sale of available-for-sale investments INCOME before income tax |

|

|

|

Net sales=

|

Net sales= Gross Sales - returns - discounts

|

|

|

|

Inventory cost =

Selling expense= G&A expenses= Non-operating = |

|

|

|

|

҉

Examples of extraordinary items: 1. 2. 3. 4. |

1. the abandonment of a plant due to an INFREQUENT earthquake.

2. An expropriation of a plant by the government. 3. A prohibition of a product line by a newly enacted law or regulation. 4. Certain gains or losses from extinguishment of long-term debt - must say unusual and infrequent. |

|

|

|

҉

Examples of NONEXTRAORDINARY items: 1.2.3.4.5. |

1. Gains or loss form sale or abandonment of property, plant or equipment used in the business

2. Large writedowns or writeoffs of: A/R, Inventory, Intangibles, Long-term securities 3. G/L from Foreign currency transactions of translation. 4. Losses from major strike by employees 5. Long-term debt extinguishments (not unusual and infrequent) |

҉

|

|

|

DISCOUNTINUED OPERATIONS – are reported separately from continuing operations in the _________. The loss from discontinued operations can consist of an Impairment loss, a Gain/loss from actual operations, and the Gain/loss on disposal. (in the period in which they occur) (iDea)

|

Income Statement

|

|

|

|

҉

CHANGE IN ACCOUNTING ESTIMATE - PROSPECTEVELY In the 3rd year of asset it estimated useful life was changed from 10 to 5. how to calc. the depreciation for current and future years? |

(BV- accum depr. ) / remaining useful life using new estimate (5-2)

|

|

|

|

IDE(A)

Accounting changes are broadly classified as (3) 1. Changes in accounting ESTIMATE - Prospective as Income from Cont. oper. 2. Changes in accounting PRINCIPLE - GR - Retrospective Change from GAAP to _________ Principal may be changed only IF new principal is _________ and _________ presents the information. 3. Changes in accounting ENTITY - Retrospective |

Change from GAAP to GAAP

preferable and more fairly |

|

|

|

҉

IDE(A) Accounting changes are broadly classified as (3) 1. Changes in accounting ESTIMATE - Prospective as Income from Cont. oper. 2. Changes in accounting PRINCIPLE - GR - Retrospective GR such changes should be recognized by adjusting _________ in the earliest period presented for the cumulative effect of the change. EXCEPTION TO GR: 1. if IMPRACTICABLE to estimate. EX: change from ______ to_______ 2. Change in the method of ________, _________and ___________ is concidered to be both a change in acct principle and change estimate. 3. Changes in accounting ENTITY - Retrospective |

beginning RE

1. LIFO to FIFO 2. Depr., Amort. and Depletion => PROSPECTEVELY |

|

|

|

Prior period adjustments are not considered ______________

|

ACCOUNTING CHANGES

|

|

|

|

Prior period adjustments:

1. Correction of __________ 2. new GAAP pronouncement 3. Changes from __________ method of accounting to ____________ |

1. ERROR

3. non-GAAP TO GAAP (from cash basis to accrual) |

|

|

|

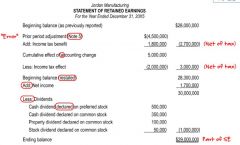

STM of R/E ҉

|

|

|

|

|

F/S prep under wich of the methods include andjustments for both

specific price ∆ and general price-level ∆ |

CURRENT COST, CONSTANT DOLLAR

|

|