![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

Pay structure |

Relative pay of different jobs and how much they are paid |

|

|

Job structure |

Relative pay of jobs on an organization |

|

|

Efficiency wage theory |

Wage influences worker productivity |

|

|

Rate ranges |

Different employees in same job may have different rates |

|

|

Key jobs |

Benchmark jobs relatively stable and common in many organizations |

|

|

Nonkey jobs |

Unique cannot be compared |

|

|

Job evaluation |

Internal measure of job worth |

|

|

Commendable factors |

Characteristics of a job an organization pays for |

|

|

Pay policy line |

Mathematical expression that describes the relationship between pay and evaluation points |

|

|

Pay grades |

Jobs of similar worth grouped for admin purposes |

|

|

Range spread |

Differences between mom and max in pay grade |

|

|

Compa ratio |

An index of correspondence between actual and intended pay |

|

|

Delayering |

Reducing number of job levels |

|

|

Comparable worth |

Policy that remedies undervaluation of women’s jobs |

|

|

Fair labor standards act |

Minimum wage and overtime pay |

|

|

Inventive effect |

Effect a pay plan has on employee behavior |

|

|

Expectancy theory |

Theory that says motivation is a function of valence instrumentality and expectancy |

|

|

Proncipal |

Seeks to direct another persons behavior |

|

|

Agent |

Acts of behalf of principal |

|

|

Sorting effect |

Effect a pay plan has on composition of work force |

|

|

Merit pay |

Base pay is increased permanently traditional |

|

|

Merit bonus |

Merit pay in form of a bonus |

|

|

Merit increase grid |

Grid that combines an employees performance rating with their position in a pay range to determine size and frequency of pay increases |

|

|

Profit sharing |

Payment on a measure of company performance or profits |

|

|

Stock options |

Employees can buy company stock at a previously fixed price |

|

|

Employee stock ownership plan |

Tax and financial benefits when stock is granted to employees |

|

|

Gain sharing |

Group compensation based on plant or group performance |

|

|

Marginal tax rate |

Percentage of an additional dollar of earnings that goes to taxes |

|

|

Consolidated omnibus budget reconciliation act |

Employers must permit employees to extend health coverage at group rates for 36 months after layoff |

|

|

Pension benefit guaranty corporation |

Agency that garuntees employees a basic retirement benefit in event that company must reduce or terminate pension plans |

|

|

Employee retirement income security act |

Increased fiduciary responsibilities of pension plan trustees portability provisions vesting rights and PBGC |

|

|

Cash balance plan |

Employee sets up individual account for each employee and contributes percentage of salary |

|

|

Summary plan description |

Employers must deceive plans funding eligibility requirements and risks within 90 days |

|

|

Family and medical leave act |

Provide up to 12 weeks unpaid leave for childbirth/ serious family issues |

|

|

Health maintenance organization |

Health care plan that provides benefits on prepaid basis require use of HMO providers |

|

|

Preferred provider organization |

Group of health care providers who contract with employers insurance companies and so forth to provide care at a reduced fee |

|

|

Financial accounting statement |

Requires companies to fund benefits provided after retirement on actual basis rather then pay as you go. And enter future cost obligations on financial statements |

|

|

Red circle vs green circle |

Red- employees make too much compared to average Green- employees make too little |

|

|

COBRA |

Extends health coverage after termination |

|

|

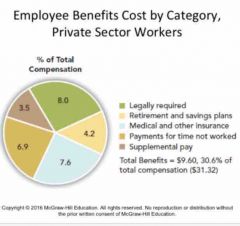

% benefit categories |

Back (Definition) |