![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

327 Cards in this Set

- Front

- Back

|

|

|

|

|

|

How long should you keep mortgage loan records under ECOA? |

25 months |

|

How long is the Do Not Call Registry good? |

When the number is disconnected, reassigned or when the consumer chooses to remove it. |

|

How many months cushion are allowed under the escrow account rules? |

2 months cushion |

|

When are escrow accounts reviewed and what amount of overage could cause a refund to the borrower? |

Reviewed annually and if the account has more than $50 in overage it will be refunded |

|

What properties are covered under RESPA? |

Single, 1-4 family dwellings, condo's and manufactured homes places on a lot. |

|

RESPA imposes restriction on ? |

Amount collected for escrow accounts |

|

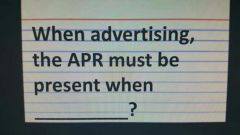

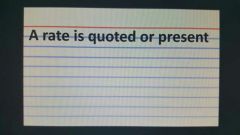

When advertising, the APR must be present when? |

A rate is quoted or present |

|

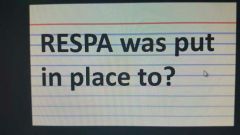

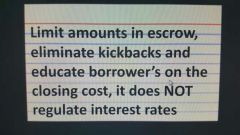

RESPA was put in place to? |

Limit amount in escrow, eliminate kickbacks and educate borrowers on the closing cost, it does NOT regulate interest rates |

|

According to RESPA guidelines, failure to comply with Section 8 could result in a penalty of ? |

$10,000 and/or 1 year prison terms for each incident. |

|

Who created and monitors a companies Red Flag Rules? |

Federal Trade Commission (FTC Red Flag Rules) |

|

At what point in conventional loan will the PMI be removed? |

When the principal Balance reaches 78% of the original value or purchase price |

|

When does a referring party have to provide the ABA format to the borrower? |

Before or at the time of the referral |

|

Advertising a mortgage loan product that a lender is not able to offer is a violation of what federal law? |

TILA REG Z |

|

What is the Act that requires a financial entities to provide customers with a privacy notice, as well as an "Opt Out Notice", regarding the customers Personal Information? |

Gramm-Leach Bailey Act |

|

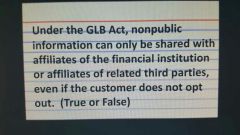

Under the GLB Act, nonpublic information can only be shared with affiliates of the financial institution or affiliates of related third parties, even if the customer does not opt out. (True or False) |

True |

|

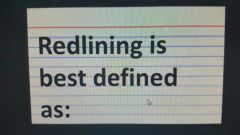

Reclining is best defined as: |

Failing to lend to certain geographic areas |

|

What information must be provided to the borrower when referrals take place between affiliated business? |

An Affiliated Business Disclosure Statement as mandated by RESPA |

|

Along with the Fair and Accurate Credit Transaction Act Disposal Rule, what GLB Act provision ensures that customer's information is not handled or maintained carelessly and is disposed of properly? |

GLB Acts Safeguards Rule |

|

What is the difference between the GLB Act Safeguards Rule and FACT Act Disposal Rule? |

GLB Acts Safeguards Rule requires all companies to design, implement, and maintain Safeguards to protect customers information from theft on the disposal of consumer report |

|

What is a "Federally Related Loan"? |

Loans secured by a first or subordinate lien on a residential property that meets stated RESPA criteria. The definition is so broad it covers virtually every home loan secured by a mortgage. |

|

What is the primary purpose of the Gramm-Leach Bliley Act? |

Notice of right to financial privacy and right to opt out of sharing personal information |

|

Most of HUD's enforcement actions result due to section 8 of RESPA. What is addressed in Section 8? |

Prohibited against giving or receiving a fee, kickback, or anything of value pursuant to an agreement or understanding for the referral of settlement business |

|

What is an Affiliated Business arrangement? |

An arrangement in which one person refers applicants to a settlement service provider with whom the referring person has ownership interest of 1% or more |

|

What customer protection does 10 of RESPA provide? |

Protect consumers by ensuring borrowers know the amount they are to deposit into escrow by preventing lenders from overcharging borrowers for escrow deposits |

|

What are the consequences for violating Section 8 of RESPA? |

Up to $10,000 and/or one year in prison |

|

What is the primary aim of Regulation B? |

ECOA is intended to promote the availability of credit to all creditworthy applicants and prohibit discrimination |

|

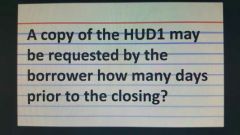

A copy of the HUD1 may be requested by the borrower how many days prior to the closing? |

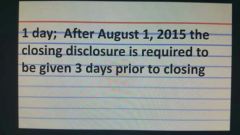

1 day; After August 1, 20th the closing disclosure is required to be given 3 days prior to closing |

|

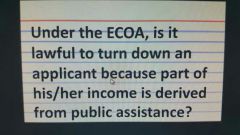

Under the ECOA, is it lawful to turn down an applicant because part of his/her income is derived from public assistance? |

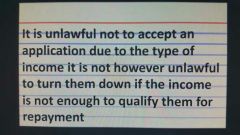

It is unlawful not to accept an application due to the type of income it is not however unlawful to turn them down if the income is not enough to qualify them for repayment |

|

What is the letter of the regulation by which the ECOA is referred? |

Regulation B (B for Borrower is protected) |

|

To whom does the TIL Act apply? (Truth in Lending Act ) |

All businesses and individuals that regularly extend consumer credit that is primarily from family or household purposes. Regularly extend credit means more than 5 mortgages per year |

|

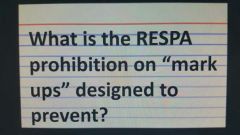

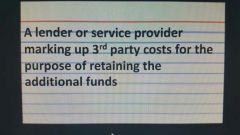

What is the RESPA prohibition on "mark ups" designed to prevent? |

A lender or service provider marking up 3rd party costs from the purpose of retaining the additional funds |

|

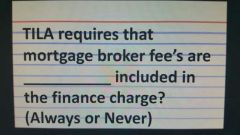

TILA requires that mortgage broker fees are ----- included in the finance charge? (Always or NeverL |

Always |

|

Under the ECOA, you must notify an applicant of Notice of Action Taken within what time period? |

30 days from receipt of a loan application |

|

Credit denial letters do not require the disclosure of ? |

Credit scores |

|

Which lending law provides that consumers get a free copy of their credit bureau report annually? |

FCRA (Fair Credit Reporting Act) |

|

Which law prohibits discrimination in residential real estate transactions? |

Fair Housing Act |

|

Which law requires institutions, that are covered by law, to collect extensive data about each mortgage loan application? |

HMDA regulation Cindy (Home Mortgage Disclosure Act) |

|

Which law apply to transactions involving the information that is used in assembled by a credit reporting agencies? (CRA) |

FCRA ( Fair Credit Reporting Act ) |

|

What does the acronym TSR represent? |

Telemarketing sales rule |

|

Red flag rules makes what requirements on creditors and financial institutions? |

To establish an identity theft prevention program outlining methods to prevent security breaches at a company wide level |

|

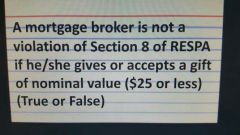

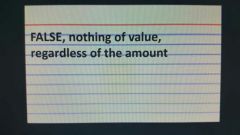

A mortgage broker is not a violation of section 8 of RESPA it she he gives or accept a gift of nominal value ($25 or less). True or False |

False, nothing of value, regardless of the amount |

|

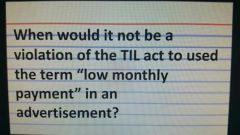

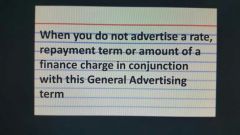

When would it not be a violation of TLA Act to use the term "low monthly payment" I'm an advertisement? |

When you do not advertise a rate, Payment terms or amount of a finance charge in conjunction with the General Advertising term |

|

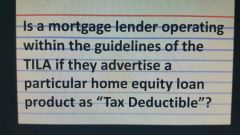

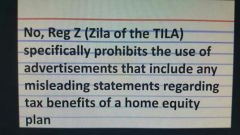

Is a mortgage lender operating within guidelines of TILA if they advertise a particular home equity loan products as "Tax Deductible "? |

No, Reg Z (TILA) specifically prohibits the use of advertisements that include any misleading get statements regarding tax benefits of a home equity plan |

|

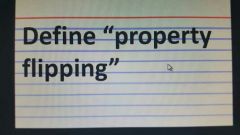

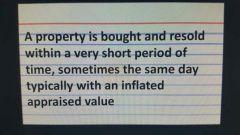

Define "property flipping" |

A property is bought and resold within a very short period of time, sometimes the same day typically with a inflated appraised value |

|

What is a straw buyer? |

An individual who accepts a free to provide his/her name, SSN and other personal information for use on a mortgage application, the motivation is to cover the true identity of the person sitting at the closing table |

|

What is a straw seller? |

An individual who accepts a fee to falsely claim ownership to a property. Falsified documents are normally used to complete the transaction (title and deeds) |

|

What is an "Air Loan"? |

A loan obtained on a property where a structure does not exist yet has been presented as having a property on the lot. |

|

Define "Equity Theft " |

Occurs when a mortgage industry employee forges a deed transfer and obtains a new lien on the property without the homeowners knowledge |

|

Under what circumstances would a sale or assignment of a sale contract be considered fraud? |

When a fraudulent real estate investor obtains a contract on a property with an inflated cause and offers to sale the contract to an unknowing buyer for a fee. |

|

What is the most common type of mortgage fraud involving borrowers? |

Fraudulent information on loan application is the most common committed by borrowers |

|

What is the primary step in detecting mortgage fraud? |

A through the "common sense" analysis of the application information and documents relating to the mortgage loan request |

|

Why is it important to check the back of pay stubs, bank statements, and W2 forms? |

To detect watermarks and printed fraud prevention patterns. Technology allows to produce high quality fraudulent documents . Most have incorporated prevention techniques. |

|

What does the phrase "Caveat Emptor" mean? |

Buyer beware - if the buyer is provided all the info and disclosures, they will ultimately be responsible for understanding the terms |

|

What is a "Buy-Back" provision in reference to table funding? |

If any format of fraud related activity takes place around a particular loan, the originator (broker) is responsible from buying the loan back |

|

What is "Equity-based Lending "? |

It occurs when loans are made to homeowners based solely on the equity in their homes with no regard to other credit. This is an unethical practice because it can "strip" homeowners of their equity and leave them with larger loans than they can pay for |

|

What is "Redlinging"? |

Failing to lead to certain geographic areas or segments of the population |

|

What is "Reverse Redlining"? |

Targeting consumers to charge them more than in rates and fees |

|

When a consumer registers on the National Do Not Call Registry, when does the request expire? |

Never, they remain permanently as of the DNC Improvement Act of 2007 |

|

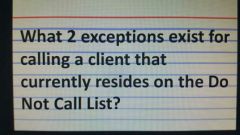

What 2 exceptions exist for calling a client that currently resides on the Do Not Call List? |

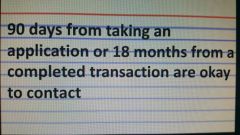

90 days from taking an application or 18 months from a completed transaction are okay to contact. |

|

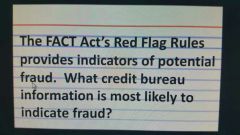

The FACT Act's Red Flag Rules provides indicators of potential fraud. What credit bureau information is most likely to indicate fraud? |

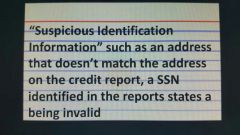

"Suspicious Indentification Information" such as an address that doesn't match the address on the credit report, a SSN identified in the report states a being invalid |

|

When is the Notice of Right to Receive appraisal given to the borrower? |

Within 3 days of application |

|

The GLBA Privacy Notice may be delivered to customers via fax, mail, or email? (True or False) |

True, in writing or electronic form. Clearly describe the institution's practice of sharing nonpublic personal information |

|

What federal law regulates settlement costs? |

RESPA (Reg X) (X stands for X-ray of your RESPA'tory system) |

|

Define "Trigger Term" |

The most attractive features of a credit plan such as: rate, finance charges, payment terms, down payments, and monthly payments |

|

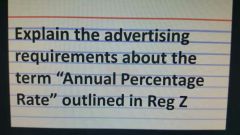

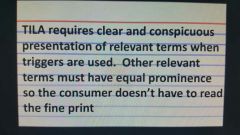

Explain the advertising requirements about the term" Annual Percentage Rate" outlined in Reg z |

TILA requires clear and conspicuous presentation of relevant terms when triggers are used. Other relevant terms must have equal prominence so the consumer doesn't have to read the fine print. |

|

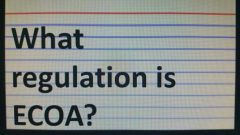

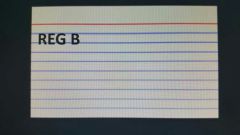

What regulation is ECOA? |

Reg B |

|

What is the purpose of ECOA? |

To make credit applications equally available and to allow the request of credit without fear of discrimination of protected classes |

|

How many years does a victim of ECOA discrimination against a violator? |

2 years |

|

What is the civil penalty for violating ECOA? |

$10,000 each violation and $25,000 for patterns of misconduct |

|

What does HMDA stand for? |

Home Mortgage Disclosure Act ( Regulation C) |

|

What is an easy way to remember RESPA is Regulation X? |

X-ray of your RESPA'tory system |

|

What is an easy way to remember TILA is Regulation Z? |

"Zila the TILA "or " unTIL I Z you again" |

|

What federal regulations allows a borrower to exercise their right to rescission? |

Regulation Z, TILA |

|

What is the fine for a violation of TILA? |

$5,000 and/or 1 year imprisonment unless class action then $500,000 or 1% of net worth |

|

What are the words behind FCRA? |

Fair Credit Reporting Act |

|

What is the DNR? |

Do Not Call Registry |

|

How often must a lender update their DNR database? |

Every 31 days |

|

Always include the APR is an advertisement when? |

Rate is presented or quoted |

|

How long does a number stay on DNR? |

Permanently unless consumer removes number or the number is assigned to another person |

|

Who takes the initiative e to place or remove a phone number on the DNR? |

The consumer |

|

What are the words behind SAFE? |

Secure and Fair Enforcement |

|

What federal Act requires creditors to allow consumers to opt out of the sale of their non-public information (NPI) |

Gramm-Leach Bliley Act |

|

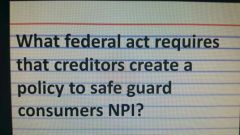

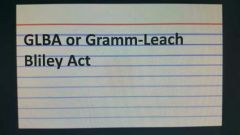

What federal Act. Requires that creditors create a policy to save guard consumer NPI? |

GLBA or Gramm-Leach Bliley Act |

|

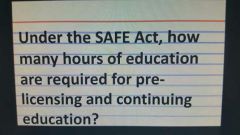

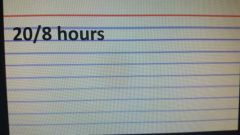

Under the SAFE Act, how many hours of education are required for pre-licensing and continuing education? |

20/8 hours |

|

Which action is a violation of GLBA? |

Obtaining customer information by flash pretenses (Known as pre-texting) |

|

How often can an MLO be investigated by authorities? |

As often as necessary |

|

The SAFE Act defines a nontraditional mortgage as ? |

Anything other than a 30 year fixed rate loan |

|

What is the waiting period for a person who seeks to license as an MLO that had a prior felony pardoned? |

No waiting period |

|

Felony convictions in the last --- years would keep a person form being able to obtain a MLO license? |

7 years |

|

MLOA Licensees who teach an approved NMLS course get --- hours CE credit for every --- they teach? |

2 for 1 |

|

Of the 8 hours annual CE needed to renew an MLO's license how many hours are devoted top ethics a day fraud? |

2 hours |

|

The NMLS accept applications for licensing for all 50 states and us occupied territories but does not have the authority to blank or blank a license. |

Approve or Deny |

|

What is the maximum state regulatory civil penalty that can be levied? |

$25,000 |

|

Offering or soliciting applications, negotiating rates and terms such with borrowers are all job functions of what type of person? |

MLO |

|

MLO's that work for a depository are defined as? |

Federally registered MLO's |

|

MLO's that work for a licensed lender or broker are defined as? |

State licensed MLO's |

|

What is used to permanently identify an MLO? |

NMLS unique identifier |

|

Licensed MLO's may work for how many entities? |

Only 1 |

|

Contract Processors and underwriters licensed as an MLO may work for how many companies? |

Unlimited |

|

A business card is considered a --- according to the SAFE ACT? |

An advertisement |

|

MLO's must retake the SAFE exam if the fail to maintain a license for a period of --- years? |

5 years |

|

How long must an MLO wait to retake a SAFE exam if they fail? |

30 days in between each failed attempt |

|

How long must an MLO wait to retake the SAFE exam if they fail a third time? |

6 months |

|

What prohibited practice is defined as requiring a borrowers to sign an exclusive contract for services where the MLO is paid whether or not the loan is found? |

Best Efforts Contract |

|

What is defined as advertising a lower rate than what is actually available? |

Bait and Switch |

|

Reports of condition must be submitted to the NMLS on an ---- basis? |

Annual |

|

Licenses expired annually on which date? |

December 31st |

|

Mortgage Lenders --- loans while Mortgage Brokers --- loans? |

Make/Arrange |

|

The CSBS and AARMR own the State Regulatory Registry (SRR) which operates which state licensing system? |

NMLS/R |

|

What is the difference between the Loan Estimate and the Closing Disclosure? |

The loan estimate provides estimated cost to close and the closing disclosure shows the actual costs at closing |

|

What is a loan modification? |

A permanent change in the terms of a loan (either term, interest rate, or both) in response to a borrower's long-term inability to make payments |

|

What is a fully amortizing loan? |

A loan on which the payments cover the principal and interest required to pay the loan balance off the schedule |

|

What is a balloon mortgage? |

Mortgage that requires the borrower to make one large Payment at the end of the loan term. This payment may also be referred to as a "call","demand", or a "bullet" |

|

Is the margin on an ARM and fixed number or is it subject to change during the term of the loan? |

The margin in an ARM is a fixed number (index + margin = new rate) |

|

What is an adjustment period? |

The agreed upon adjustment frequency established in the ARM |

|

What is a lifetime rate cap? |

A limit on the amount an interest rate can change over the life of an ARM ( aka rate ceiling) |

|

COFI, LIBOR, T-Bill are all examples of? |

No index usually associated with an ARM |

|

What is the confirming loan limit for a one-family property? |

$417,00 (this limit goes up to $625,500 for high cost areas) |

|

What is a periodic rate cap? |

A limit on the amount that the interest rate can change during any adjustments periods |

|

What is an initial rate cap? |

A limit on the amount that the interest rate can increase during the first adjustment period for an ARM |

|

What is a negative amortization? |

A monthly mortgage payment is not large enough to pay all of the interest due on the mortgage therefore the balance is not reduced, also known as deferred interest |

|

In a bi-weekly mortgage payment plan, how many extra mortgage payments are made every year? |

One extra payment. Bi-weekly collects payments every two weeks resulting in 13 payments |

|

What is a conforming loan? |

A conventional loan, (one NOT insured by the government) that meet the guidelines for purchase established by FNMA or FHLMC |

|

What is a variable rate mortgage? |

A mortgage with an interest rate that may change one or more times during the life of the loan |

|

What is a non-conforming loan? |

A conventional loan that does not meet the FNMA or FHLMC guidelines |

|

Which non-conventional loan has a funding fee? |

VA has a funding fee. The fee ranges from .5 to 3.3 but is waives for qualifying disabled veterans. Remember, a non-conventional loan is one that is insured by the federal government |

|

What is the maximum loan guaranty from the VA? |

The maximum VA home loan guarantee is 25% of conforming VA home loan amount |

|

What is a payment cap? |

A limit on the amount the payment can change during one adjustment period on an ARM |

|

What is a conventional loan? |

A loan NOT insured by the government. (NOT a FHA,VA, or USDA loan) |

|

What is the maximum entitlement amount for a veteran? |

4 times the amount listed on COE |

|

Does the FHA (federal hosuing administration) make loans? |

No...FHA and VA do not not make loans they insure(FHA) or guarantee (VA) |

|

Which non-conventional loan is made for the purpose of assisting low-income borrowers purchasing homes in rural areas? |

USDA (US Department of Agriculture) aka Guaranteed Rural Housing Loans |

|

The Dept of Veterans Affairs requires each veteran to obtain a Certificate of Eligibility? (True or False ) |

True, it's also referred as the COE |

|

Can a borrower get an FHA insured loan for a condominium? |

Yes, in addition to the primary fixed rebate program for the purchase or refinance of 1-4 family dwellings, FHA offers programs for the purchase of a condominium |

|

What is the difference between a non-conforming loan and non-conventional loan? |

Non-conventional loans are government insured loans while non-conforming loans are conventional loans (non government loans) that don't mean FNMA and FHLMC underwriting guidelines |

|

What is the time frame a borrower has to take possession and move into the house after closing? |

60 days |

|

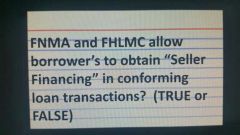

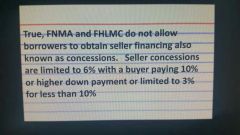

FNMA and FHLMC allow borrower's to obtain "Seller Financing" in conforming loan transactions? (True or Flase) |

True, FNMA and FHLMC do not allow borrowers to obtain seller financing also known as concessions. Seller concessions are limited to 6% with a buyer paying 10% or higher down payment or limited to 3% for less than 10% |

|

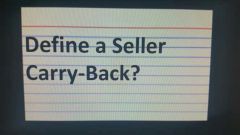

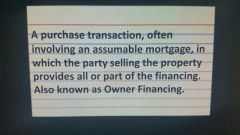

Define a Seller Carry-Back? |

A purchase transaction, often involving an assumable mortgage, in which the party selling the property provides or part of the financing. Also knows as Owner Financing |

|

Define a Fully Indexed Rate? |

In an ARM, the interest rate indicated by adding the current index value and the margin |

|

Define Amortization? |

Periodic payments on a loan requiring Payment for enough principal and interest to ensure complete repayment of the loan by the end of the loan term |

|

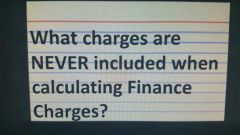

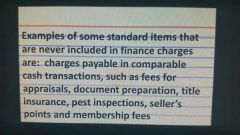

What charges are NEVER included when calculating Finance Charges? |

Examples of some standard items that are never included in finance charges are: charges payable in comparable cash transactions, such as fees for appraisals, documents preparation, title insurance, pest inspections, seller's point and membership fees |

|

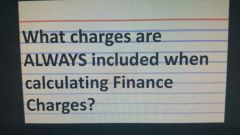

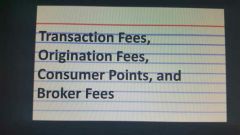

What charges are ALWAYS included when calculating Finance Charges? |

Transaction Fees, Originator Fees, Consumer Points, and Broker Fees |

|

Define "Rate Discount" |

Also known as a permanent buy buydown, a rate discount allows the borrower to pay a discount point (s) to permanently reduce the rate of the mortgage |

|

Define "point" |

1% of the loan amount is equal to a point. Example, 1 point on a $100,000 loan would be equal to $1,000 and 3 points would be equal to $3,000 |

|

When must the affiliated business agreement disclosure be given to the borrower? |

Before or during the referral by the referring party |

|

Define "Buy Down " |

The paying of fees (buying) to reduce (down) the payments on a mortgage and qualifying for a larger loan. A buy down may be permanently or temporary. |

|

Define "Creditor) |

A person or entity to whom an obligation is owed, such as a loan |

|

What is the difference between Finance Charge and Annual Percentage Rate? |

Finance Charge is a uniform measurement of the cost of a loan expressed in a dollar amount and an APR is measurement of the cost of a loan including interest and financed cost of closing, expressed in a yearly percentage |

|

Mortgage brokers fee are always included in the finance charge? (True or False) |

True |

|

A 10-year old property is being sold. What is the best approach for an appraiser to evaluate the property? |

Market approach is also know as Sales Comparison Approach or Market Data Approach |

|

Which type of automated underwriter does Fannie Mae and Freddie Mac use? |

FNMA uses Desktop Underwriter(DU) answer FHLMC uses Loan Prospector (LP) |

|

What is the "worst case scenario" for an ARM? |

The worst case scenario is the highest interest rate the loan could produce over the life of the loan based on the interest rate and adjustment cap |

|

What is a COFI loan? |

An adjustable rate mortgage that uses the Cost of Funds Index (COFI) for interest rate adjustments |

|

What is a fully indexed rate ? |

Also known as the Fully Indexed Accurate Rate (FIAR). This is the "real" or "true" interest rate of an ARM. ARM's often. Have introductory or temporary discounted rates. The full indexed rate is the result of adding the index and margin. |

|

What is the tenancy by the entirety? |

One of the ways to own property by more than one person (concurrent ownership). The co-owner must be husband and wife, both of whom own the whole property. When one of the two dies their interest goes to the surviving spouse |

|

What percentage of down payment is required on USDA loans? |

Zero - 0% |

|

What is a temporary buy-down? |

Borrower places funds in escrow is an amount sufficient to offset the monthly payment required by the terms of the loan for the desired period. These funds temporarily reduce the payment amount, the note rates doesn't change during the buy-down period |

|

What are Fannie Mae and Freddie Mac? |

GSEs- Government Sponsored Enterprises, which are not government agencies but have the implied support of the government, they purchase pools of loans that conform to their guidelines, and sell mortgage backed securities |

|

Instead of mortgage insurance, every VA (and USDA ) loan includes what type of fee? |

Funding fee |

|

FHA down payment funds can be from borrower's own fund, gift funds, or housing authority grants (True or False) |

True |

|

What is the difference between a mortgage broker and a mortgage banker? |

Brokers arrange loans through a banker or lender and brokers don't funds the loans. Bankers originate and fund loans in their own name for resale in the secondary market |

|

At what LTV does the Homeownership Protection act require the PMI is automatically discounted on a loan by the lender? |

78% LTV. A homeowner can request the lender from PMI when the LTV reaches 80% but PMI is not automatically dropped til 78% (22% equity position) |

|

What is the difference between PMI or MIP? |

PMI is Private Mortgage Insurance is required by lenders on conventional loans where the LTV is more than 80% and MIP is Mortgage Insurance Premium is required on FHA loan regardless of the LTV |

|

What does the acronym PUD represent? |

Planned Unit Development. Most commonly a subdivision having common areas reserved for the use of some or all of the property owners in development |

|

What is a Lock-In Agreement? |

An agreement made by a lender to hold (lock-in) specified number of points whole processing an applicants loan |

|

What is joint tenancy? |

Equal and undivided ownership of a property by 2 or more individuals, taking possession together and acquiring title at the same time. When one co-owner dies, their interest goes to the other co-owner(s) |

|

What is a jumbo loan? |

A loan that exceeds the maximum loan limits backed by FNMA and FHLMC ( loans in excess of $417,000) |

|

What is the difference between the primary and secondary mortgage lending market? |

Primary is made up of all activities involved in the origination and closing of loans. The secondary is where previously made loans are bundled and sold to investors |

|

What is a float agreement? |

A type of lock in agreement that allows the interest rate or points to rise and fall with the market while the processing the loan. You may lock in rates and float points, lenders may agree to float both |

|

What is a subprime loan? |

Loans made to borrowers whose debt to income ratio (DTI) or credit characteristic do not meet the guidelines of Fannie Mae or Freddie Mac |

|

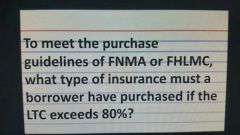

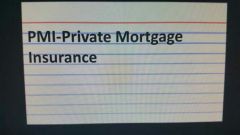

To meet the purchase guidelines of FNMA or FHLMC, what type of insurance must a borrower have purchased if two LTC exceeds 80%? |

PMI - private mortgage insurance |

|

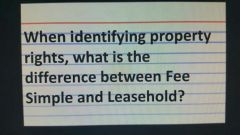

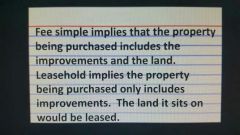

When identifying property rights, what is the difference between Fee Simple and Leasehold? |

Fee simple implies that the property being purchased includes the improvements and the land. Leasehold implies that the property being purchased only includes improvements. The land it sits on would be leased. |

|

What does the PITI stand for ? |

Principal, Interest, Taxes, and Insurance (PITI) |

|

Which mortgage loan documents contains the borrower's contractual promise to pay? |

Note (or promissory note). Neither a mortgage or a deed of trust contains a contractual promise to pay |

|

VA funding fee is not charged to eligible veterans or their spouses, or spouses of Veterans who died in service (True or False) |

True |

|

What is an index? |

Published interest rate that is used as the basis upon which the note rate of an ARM will adjust. Typical indices are Treasury Bills Index, the 11th District Cost of Sunday Indexes (COFI) and the London Interbank Offered Rate (LIBOR) |

|

What is a permanent buy-down? |

The use of discount points to lower the rate of interest of the full term of loan |

|

What is the difference between a judicial foreclosure and a non-juficial foreclosure? |

Judicial - the mortgage includes a clause that requires the lender to file a lawsuit, requesting the court to enter an order to foreclosure. Non-judicial - the deed of trust includes a power of sale clause allowing the lender to being foreclosure without filing suit. |

|

What is the finance charge? |

A uniform measurement of the cost of the loan expressed as a dollar amount |

|

What is an interest only loan? |

A loan that requires only interest payments. At the end of the loan, the borrower essentially owns a balloon payment at the entire principal of the loan |

|

What is a seller carry-back? |

A purchase transaction, often involving and assembly mortgage in which the party selling the property provides all or part of the financing |

|

What is a short sale? |

When the lender agrees to reduce pay off on a loan when the subject property is sold |

|

Can a VA loan be assumed? |

Yes, VA may be assumable. The buyer must meet credit qualifications, but does not have to be a veteran |

|

What is a note rate? |

The stated interest rate on a mortgage or loan agreement |

|

What are Service Release Premiums? |

Fees which lenders may receive for selling or transferring a mortgage loan servicing rights |

|

A second mortgage is also known as a subordinate lien. (True or False) |

True, also known as a junior mortgage |

|

What is the primary difference between the Good Faith Estimate (GFE) and the HUD1 settlement statement? |

GSE is an estimate of cost at closing and HUD1 is the cost at closing |

|

What is a Home Equity Conversion Mortgage (HECM)? |

Allows an older homeowner to use the equity in their home to received fixed monthly payment, line of credit or a combination of payments and credit line. Borrowers must complete counseling with a HUD approved HECM counselor in order to obtain the loan. |

|

What factor does not affect the money received in a HECM loan? |

Age of property |

|

Best appraisal approach to use when determining the value of a rental property? |

Income approach |

|

What is securitization? |

The bundling of mortgage loans to resell to investors, they become mortgage backed securities (MBS) and are sold on the secondary market |

|

What are Service Release Premiums? |

The revenue earned from the resell of pools of loans to investors |

|

LIBOR stands for? |

London Interbank Offered Rate |

|

Margin for ARM's are set by: |

The Investor/Lender |

|

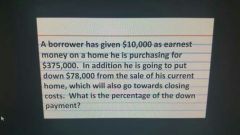

A borrower has given $10,000 as earnest money on a home he is purchasing for $375,000. In addition he is going to put down $78,000 from the sale of his current home, which will also go towards closing costs. What is the percentage of the down payment? |

23% which is the down payment and closing as cash to closing |

|

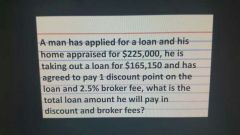

A man has applied for a loan and his home appraised for $225,000, he is taking out a loan for $165,150 and has agreed to pay 1 discount point on the loan and 2.5% broker fee, what is the total loan amount he will pay on discount and broker fees? |

$5,780.25 |

|

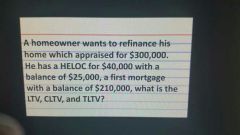

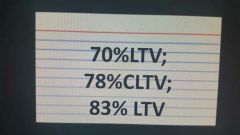

A homeowner wants to refinance his home which was appraised for $300,000. He has a HELOC for $40,000 with a balance of $25,000, a first mortgage with a balance of $210,000, what is the LTV, CLTV, and TLTV? |

70% LTV 78% CLTV 83% TLTV |

|

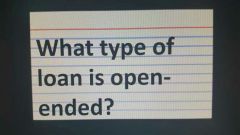

What type of loan is open-ended? |

HELOC |

|

Which lien take precedence on title? |

The mortgage recorded first |

|

What type of lien has priority over all others? |

Taxes |

|

Who earns SRP? |

Lender |

|

Margins on ARMs are not subject to change during the entire term of the loan? (True or False) |

True |

|

What information is not provided on the Notice of Adverse Action Letter? |

Credit score |

|

What term is associated with transferring title? |

Conveyance |

|

What term is associated with a lender releasing their lien upon full payment? |

Reconveyance |

|

What document is used to release a mortgage lien? |

Satisfaction of mortgage |

|

What equity position is PMI removed automatically? |

22% |

|

What law prohibits kickbacks and referral fees? |

RESPA |

|

Under what circumstance is it okay to discriminate based on age? |

Too young to enter a legally binding contract |

|

What type of loan has a fixed rate of 6.5% for the first 5 years and 7.5% for the remaining 25 years |

Variable rate |

|

How long is a Loan Estimate Good from issuance? |

10 days |

|

What is a permanent change in a borrowers loan term in response to their long-term inability to pay known as? |

Loan modification |

|

What loss mitigation strategy is a temporary reduction of the borrower's payment while they pay past due amounts? |

Forbearance |

|

When does an ABA form have to be given to a client? |

At the time the referral is made by the referring party |

|

How long does MIP stay on an FHA or a borrower puts less than 10% down? |

Lifetime of the loan |

|

What would keep property from transferring free and clear? |

Failing to pay off a loan |

|

What automated underwriting system (AUS) does (FHLMC) Freddie Mac use? |

LP loan prospector |

|

What type of loan can not be repurchased? |

No bid |

|

In order for a loan to fall under the Safe Harbor rules of a qualified mortgage, what is the maximum allowed debt ratio? |

43% |

|

Under the cute and rules lenders must use what rate to determine if a borrow me the ability to repay rules? |

Fully indexed rate or start rate whichever is lower |

|

Lenders must notify borrowers of their right to receive a copy of the appraisal within? |

Three days of application and provide probably no later than 3 days |

|

What is the maximum net adjustment allowed on the appraisal? |

15% |

|

Indexed rate on a 3/1 by down with a start rate of 4%? |

7% |

|

325 bps translates to what interest rate? |

3.25% |

|

What amount does flood insurance cover? |

100% of structure |

|

What is the minimum amount of flood insurance required? |

80% of dwelling |

|

A profit entity offering to assist a borrower with a loan modification, short sale or principal reduction is known as? |

MARS (Mortgage Assistance Relief Service |

|

When can a MARS collect payment for service |

After the modification is complete |

|

Title X of the Dodd Frank Act created with new regulatory entity? |

CFPB Consumer Financial Protection Bureau |

|

What percentage of a company must an applicant own in order to request your tax return for verification of income? |

25% or more |

|

What is mortgage fraud warning notice? |

Notice from the FBI that fraud is investigated by FBI and is punishable by up to 30 years in federal prison and 1 million dollars or both |

|

What documentation is required for a buyer who has Commission income? |

Copies of income tax returns for the past two years and information on current income of commissions represent 25% or more of the annual income |

|

When is the Loan Estimate required to be provided to the customer? |

RESPA requires within three business days after the application |

|

What is the purpose of Form 1003; Uniform Residential Loan Application (URLA)? |

It's the standard application for a mortgage loan |

|

When is the ABA disclosure required to be provided to customer? |

At the time of the referral |

|

What is the difference between the VOE and the VOD? |

VOE verifies employment and year to date income and the VOD verifies the status and balance of financial account (s) |

|

What is the key information on the Mortgage Servicing Disclosure Statement? |

The likelihood (express as %) that the servicing on a mortgage will be sold or transferred to another party |

|

What documentation is required for a borrower who is self-employed? |

A self-employed applicant must show through adjusted gross income on tax returns that he has maintained and income for two years in order to qualify for a mortgage loan |

|

When is a mortgage servicing disclosure statement required to be provided to the customer and which regulation mandates it? |

RESPA - Regulation X. States that it must be provided within 3 business days after application on purchase transactions |

|

When is the servicing transfer statement required to be provided to the consumer from the lender who is selling the loan? |

RESPA requires a 15 day notice prior to the effective date of the transfer. New services is to also provide notice 15 days after the transfer |

|

What is the difference the calculation of front end and back end ratio? |

Front is the housing payment (PITI)calculated from the gross monthly income and the back end is the house payment plus the consumer debt as compared to the monthly gross income |

|

At the front-end and back-end ratios calculating using gross or net income? |

Gross Monthly Income |

|

A borrower makes $18 per hour, working a 40 hour work week, what is his gross monthly income? |

$3,120 per month - breaks down as $18 per hour X 40 X 52 / 12 |

|

Can overtime income always be used to qualify for a loan? |

As long as the borrower has been receiving overtime for two years and employer can verify it will continue |

|

A borrower earns $1,350 bi-weekly income before taxes, what is his gross monthly they income? |

$2,925: $1,350 x 26 weeks ÷ 12 months gives monthly average |

|

When can child support and separate maintenance be used as income? |

If court ordered and shows a stable history of receiving payments. Must show proof and 3 year continuance |

|

What is the difference between a voluntary and involuntary lien? |

Voluntary is one that the owner give consent to the lien such as a mortgage. Involuntary is one such as a Tax lien, or other unpaid debt |

|

The Back-end ratio is known by what other names? |

Debt Ratio, Debt to Income Ratio (DTI), Bottomed Ratio or Total Ratio |

|

What category on the URLA would be check-marked to represent a marital status of single? |

Unmarried |

|

How is LTV calculated |

Loan amount requested or principal balance divided by appraised value or purchase price (which ever is less) |

|

What is the difference between LTV and CLTV? |

LTV takes into consideration only the first mortgage balance and the CLTV considers both the first and all other mortgages on the home |

|

Under what circumstances would the debt of a non-purchase spouse be included in the applicant's qualify ratios? |

When the applicant resides in, or if the property is located in, a community property state |

|

How is the back-end ratio calculated? |

It considers the house payment and all other consumer debt (recurring debt) and divided by gross monthly income (PITI + Recurring Debt/ gross monthly income = Back end ratio) |

|

As a general rule, what percentage of rental income stated on the rental agreement will be used to help qualify the borrower? |

Vacancy factor is 25%, so 75% will be used unless otherwise noted on the 1040 Schedule E-Real Estate |

|

What does the acronym URAR represent? |

Uniform Residential Appraisal Report |

|

On a professional home appraisal, what is the difference between a sales comparison approach and a cost approach? |

Sales approach looks at recent sales in the area that have similar characteristics to the subject home and the COST approach assumes used to it cost to construct a substitute residence that has the same utility and uses the subject property being appraised |

|

What category on the URLA would be check-marked to represent a marital status of "divorced", "widowed", "never been married"? |

Unmarried |

|

If four borrowers received a right of rescission for a specific loan, how many of them would be requires to return the right of recession in order to cancel the loan? |

Only one person would need to execute the rescission notice |

|

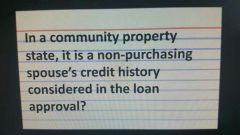

In a community property state, it is a non-purchasing spouse's credit history consider in the loan approval? |

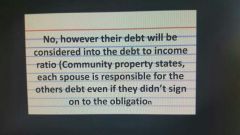

No, however their debt will be considered into the debt to income ratio (Community property states, each spouse is responsible for the other debt even if they didn't sign on to the obligation) |

|

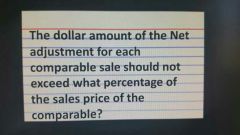

The dollar amount of the net adjustment for each comparable sale should not exceed what percentage of sales price of the comparable? |

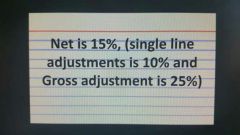

Net is 15% Single line adjustment is 10% Gross adjustment is 25% |

|

The front-end ratio is known by what other names? |

Housing Ratio, Housing Expense, Ratio to Top Ratio |

|

What type of approach is used by an appraiser to determine the value of an investment property? |

Income approach |

|

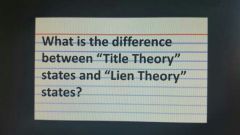

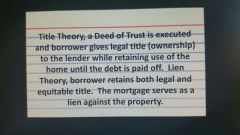

What is the difference between "Title Theory" states and "Lien Theory" states? |

Title Theory - a Deed of Trust is executed and borrower gives legal title (ownership) to the lender while retaining use of the home until the debt is paid off. Lien Theory - borrower retains both legal and equitable title. The mortgage serves as a lien against the property |

|

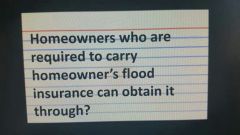

Homeowners who are required to carry home owner's flood insurance can be obtain it through? |

Private Insurance Carriers |

|

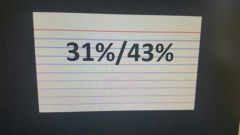

What are the front and back-end ratio percentages used by FHA? |

31/43 |

|

What is a Chain of Title on a property? |

A record of all transfers of ownership of subject property |

|

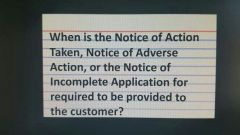

When is the Notice of Action Taken, Notice of Adverse Action, or the Notice of Incomplete Application form required to be provided to the customer? |

ECOA - 30 days from application |

|

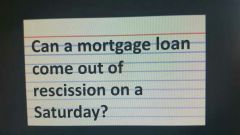

Can a mortgage loan come out of rescission on a Saturday? |

Yes, a loan becomes eligible for funding three business days after closing. Those days are aren't day other than Sunday and legal public holiday |

|

What are the front and back-end ratio percentages used by a VA? |

NA/41% There is not front end ratio for VA loans |

|

What does rescission mean? |

A legal remedy to void a contract between two parties, restoring each to the position held prior to the transaction |

|

Who is required to be given a right to rescind by the lender? |

Any person signed on the note or who has ownership interest in the property being used to secure the love must be given two copies |

|

In calculating the time limitations for the right to rescind, what days are not considered "business" days? |

Sunday and federal public holidays. If the feds don't work they don't enforce |

|

Fannie Mae and Freddie Mac utilize what front end and back rent ratios for housing? |

28 / 36 |

|

For both closing or open and credit, how long is the recession. If the creditor fails to provide a recession notice that meets the requirements for notification, or failed to disclose all the terms of the lending transaction as required under TILA? |

|

|

Generally, account information, including late payments and other adverse info, is kept on a credit report for no longer than how many years? |

7 years |

|

What is table funding? |

A type of wholesale lending arrangement when mortgage brokers are permitted to originate, and close a loan in their name for a wholesaler who has made the credit decision and funded the loan with an immediate assignment by the broker after closing |

|

What agencies gather and sell info regarding an applicants credit in the form of credit reports? |

Consumer Reporting Agencies (CRS's), Equifax, Experian, and Trans union |

|

If a loan servicer transfer,sells, or assigns the loan, the servicer must notify the borrower at least --- days before the effective date of transfer? |

15 days from the seller of the loan and 15 days after the loan has been transferred is the new servicer required to send the notice |

|

How is GNMA different than FNMA and FHLMC? |

GNMA is a government agency, the others are not. GNMA insures FHA,VA, USDA, and HECM. FNMA and FHLMC purchase conventional mortgage loans |

|

Generally, how long do unpaid tax liens remain on credit reports? |

Indefinitely, however, some jurisdictions ha e different requirements with greater consumer protections |

|

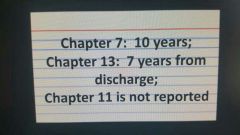

How long does a bankruptcy remain on a credit report? |

Chapter 7 - 10 years Chapter 13 - 7 years from discharge Chapter 11 is not reported |

|

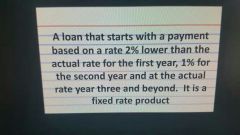

What is a 2/1 temporary buy down? |

A loan that starts with a payment based on a rate 2% lower than the actual rate for the first year, 1% for the second year and at the actual casual rate year three and at the actual rate year three and beyond. It is a fixed rate product |

|

What type of mortgage does not require the borrower to pay back the loan as long as he continues to live in the home ? |

HECM or reverse mortgages |

|

Reverse mortgage requires income and credit approval. (True or False) |

False |

|

Which type of ARM allows the borrower to choose from a variety of payment options each month? |

Payment Options Arms: allows a borrower to choose from 4 options to make their payment each month...30 year payment, 15 year payment, interest only payment or a minimum payment resulting in negative amortization. |

|

Is a VA loan assumable? |

Yes, as long as the buyer qualifies and the funding fee is .5% for the VA assumption |

|

What is used to determine the value of a home when doing a VA loan? |

Notice of Value (NOV) |

|

In a VA loan, what is the upfront fining fee on the loan? |

2.15 for active duty (first time users) and 2.4 for reserve or guard |

|

What is the fee for a 2nd and 3rd time use of a VA loans? |

3.3% |

|

Can a VA funding fee be waived? |

Yes, is case of a service connected disability or surviving spouse of a veteran who had a service connected disability |

|

Is there a refund of the VA funding fee in the refinance or sale of a VA loan? |

Funding fee are returned is miscalculated or if the veteran would have been exempt |

|

What does FHA Stand for? |

Federal Housing Administration |

|

Which type of loan has no monthly mortgage insurance? |

VA loans |

|

Under FNMA guidelines, how long does a borrower have to move into a property once they close on a owner occupied loan? |

60 days |

|

A Certificate of Eligibility is required for what type of loan? |

VA Loans |

|

What best describes an FHA loan? |

A loan that is backed by a federal government |

|

What does SRP stand for ? |

Service Release Premium: this is the amount a lender would receive over and above the current outstanding hence as a premium on sale of loan in the secondary market |

|

30/15 and 180/360 represent what type of loan? |

Balloon Mortgage; 30 year amortization with a 15 year ballon |

|

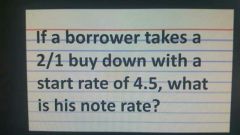

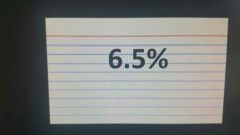

If a borrowers takes a 2/1 buy down with a start rate of 4.5, what is their note rate ? |

6.5% |

|

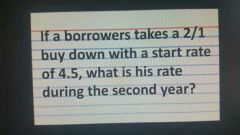

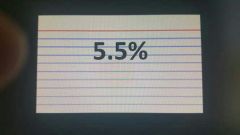

If a borrowers takes a 2/1 buy down with a start rate of 4.5, what is their rate during the second year? |

5.5% |

|

What is the maximum LTV for FHA loans? |

96.5% |

|

What is the minimum down payment of an FHA loan? |

3.5% |

|

What is the back-end DTI ratio for an FHA loan? |

31%/43% |

|

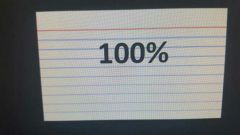

What is the maximum LTV for VA loans? |

100% |

|

What is the loan entitlement? |

4 times the COE |

|

What is the maximum COE on a VA loan, expressed in a dollar amount? |

$36,000 |

|

What is the maximum origination fee that can be charged to a veteran on a VA Loan? |

1% |

|

What is the front and back-end ratio for a USDA loan? |

29%/41% |

|

What is the maximum LTV for a USDA loan and what is the maximum LTV if funding fee is financed? |

100%/102% |

|

What is the funding fee on a USDA loan? |

2% |

|

What is the only term for a USDA loan? |

30 years |

|

Is there a down payment on a USDA loan? |

No |

|

Which FNMA form number is known as the Transmittal Summary? |

1008 |

|

What three items best describes what a lender or underwriter should consider when making a credit decision? |

Credit, Capacity, and Collateral |

|

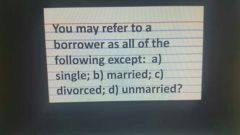

You may refer to borrowers as all of the following except? |

Divorced |

|

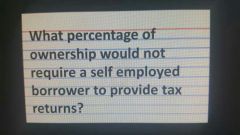

What percentage of ownership would not require a self employed borrower to provide tax returns? |

25% |

|

FEMA stands for? |

Federal Emergency Management Agency |

|

Which forms number represents the Request for Copy of Tax Transcripts? |

4506T |

|

How many days does a seller have to wait till a home for profit if the new home buyer is using a FNMA loan product? |

Right away, zero days |

|

Which of the following do no effect the VA funding fee? Marital status, down payment, or disability? |

Martial status |

|

What does POC stand for? |

Paid out of closing |

|

What does PFC stand for? |

Pre-paid Finance Charge |

|

What does GNMA stand for? |

Government National Mortgage Association |

|

What does FNMA stand for? |

Federal National Mortgage Association |

|

What does FHLMC stand for? |

Federal Home Loan Mortgage Corporation |